The article is in press on gurufocus.com (submitted August 28, 2025) . As soon as I'll have a sharable link, I'll put it here.

In the meantime here's the summary in three bullet points and a TL;DR in 9 points, plus an extract of the proposed strategy.

Summary

- Novo Nordisk's stock has dropped significantly, with a dramatic year-to-date performance of -45%, due to a revised sales forecast and increased competition from rivals like Eli Lilly.

- While both a bull and bear case can be made, the company's valuation is historically low, suggesting Mr. Market overreaction.

- A long-term options strategy (LEAPS call) is presented as a way for investors to capitalize on a potential rebound with a smaller capital outlay than buying shares directly.

TL;DR: Novo Nordisk Stock Decline and a Call Option Strategy

1. Stock Stumble: Novo Nordisk (NVO) stock has dropped significantly, falling 45% year-to-date from a high of $140 to around $50, triggered by a Q2 2025 earnings report and a cut in its full-year sales forecast.

2. Market Overreaction: Mr. Market may have overreacted to the news, as the company is still projected to grow (single-digit) and its core business remains.

3. Increased Competition: A key factor in the stock decline is fierce competition from Eli Lilly, whose drugs (Mounjaro and Zepbound) are gaining market share, and the rise of cheaper "compounded drugs."

4. Internal Issues: Other headwinds include a leadership transition, disappointing trial results for a next-generation drug, and potential pricing pressure from the US Administration.

5. Valuation Gap: The stock's valuation is historically low, trading at a forward P/E of 14x, which is significantly lower than Eli Lilly's 46x, creating a major valuation gap.

6. Long-Term Moat: Novo Nordisk still has a nice market position, with a patent-protected product pipeline and key drugs like Ozempic and Wegovy. They are also investing in new drugs, including an oral version of Wegovy.

7. LEAPS Call Option Strategy: The article proposes a long-term equity anticipation securities (LEAPS) call option as a way to capitalize on a potential rebound with less capital than buying stock directly.

8. Risks to Strategy: The entire premium paid for the option can be lost if the stock doesn't reach the break-even point by the expiration date. However, it offers significant leverage and higher percentage returns in a bull case scenario. The LEAPS call option is presented as an alternative to direct stock ownership for investors who believe the company will rebound.

-

Extract from the in-press article:

Pounding the Allocation, a LEAPS Call Strategy on NVO

Assuming an investor is looking to profit from the valuation gap in NVO and is willing to buy 100 shares in the company, here's an alternative strategy to consider.

It is known that options trade in multiples of 100 shares, meaning that one option contract (of the call type), gives the right (but not the obligation) to buy 100 shares of the underlying company at a future time, all this at a proportionate cost called a premium. Very similar to how insurance works. You pay a small premium upfront to have the opportunity to get a bigger reward if certain conditions are met.

If the future time of the option (called the expiration date) is beyond one year, the option is called “LEAPS”, short for Long-term Equity AnticiPation Securities.

The strategy proposed intends to use just that, a long LEAPS call option to capitalize on a potential rebound at a fraction of the present cost of buying one hundred shares. The specific contract to be analyzed is NVO271215C00060000 (a long call due on January 15, 2027, with a strike of $60.00 and a premium of $9.95).

The break-even point (BE) for this trade is calculated by adding the strike price to the premium: $60.00 + $9.95 = $69.95. This means the stock must appreciate to at least $69.95 by mid January 2027 - meaning an appreciation of 27% from current price of $54.78 - for the trade to be profitable.

While the long-term expiration mitigates the risk of rapid time decay, this is not risk-free. The primary risk is the loss of the premium if the stock does not reach the break-even point (loss that is reduced as the price approaches the BE).

The success of this strategy hinges on the belief that Mr. Market has mispriced Novo Nordisk in this short time and that in the following 16 months, the sentiment will change upward.

The investor could avoid the Company in total, or she can think that the trend will reverse and either buy direct equity ownership with say 100 shares costing $5'478 ($54.78/share x 100 shares). Or it can pay now a premium of $9.95 for every future stock to be purchased for a total of $995 (plus applicable fees generally around a fraction of a percentage point of the premium), hence putting up now just 18.2% of the capital and saving the remaining $4'483 for other higher conviction names, without losing on NVO.

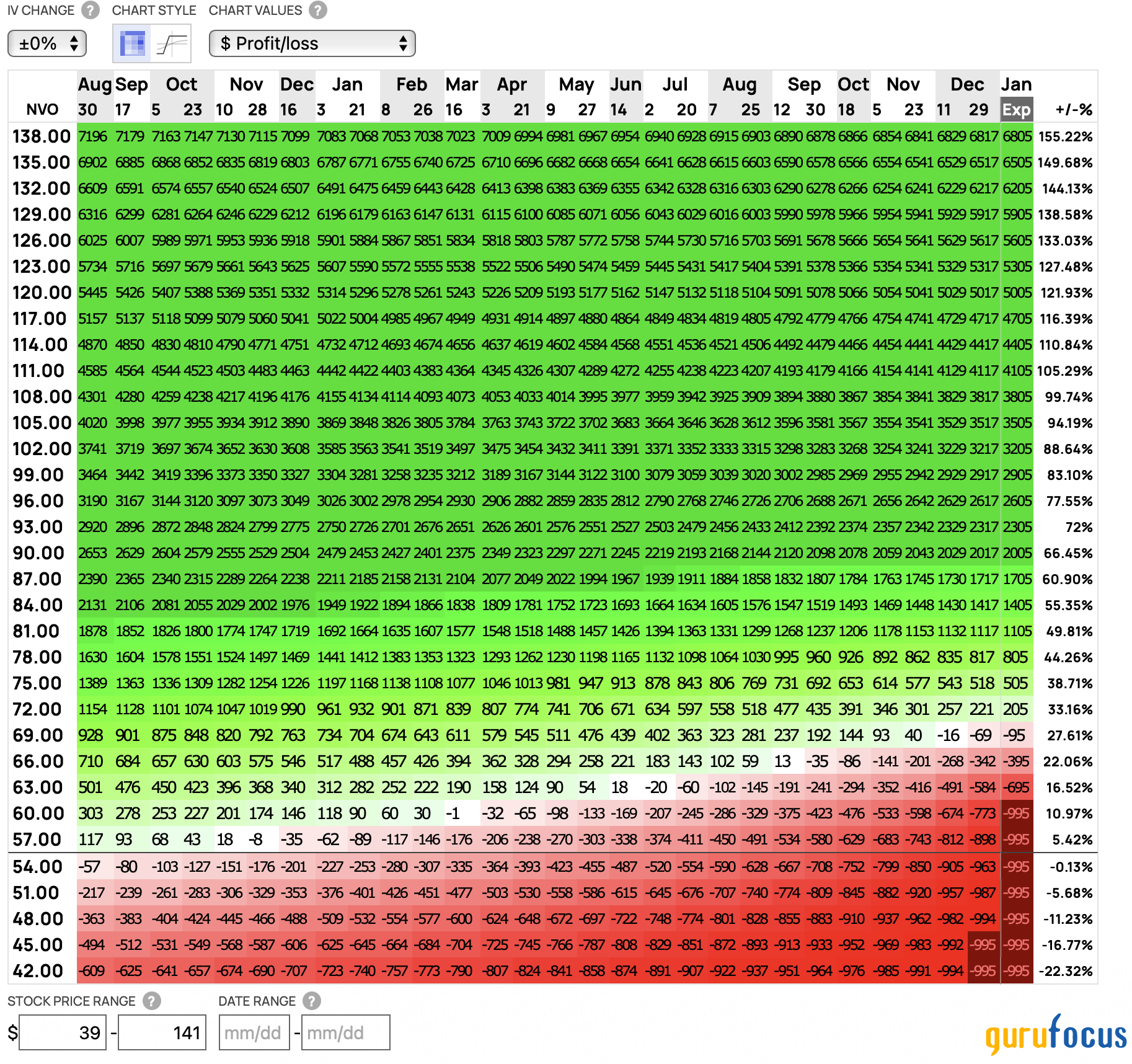

Source: Options Profit Calculator for the strategy presented. In green the profitable outcomes, in red the unprofitable ones. On the left side the stock price in absolute numbers; on the right side the stock price in relative terms vs. actual price of $54.78 .

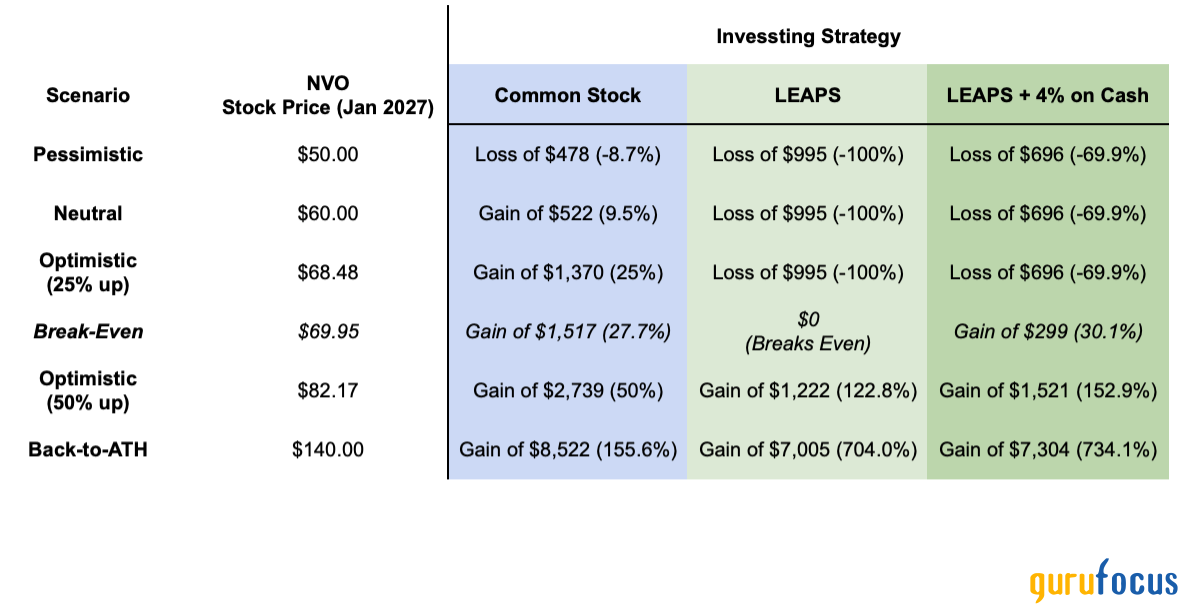

An analysis of potential scenarios for Novo Nordisk is presented in a separate chart, created for easiness of use. It reveals the distinct risk-reward profiles of investing in LEAPS options versus buying common stock. The buying of 100 shares was assumed as the base scenario, since option contracts trade in multiples of one-hundread. A direct purchase of 100 shares offers a more straightforward, linear payoff: as the stock rises, your profit grows at a proportional rate. However, a LEAPS strategy, while requiring only a fraction of the initial capital, is an all-or-nothing strategy. If the stock appreciates by a modest amount (e.g., a 25% increase) that do not surpass the “break-even”, the option may expire worthless, resulting in a 100% loss of the premium paid.

The true power of the LEAPS strategy becomes apparent in the most optimistic scenarios. If Novo Nordisk rebounds to its all-time high of $140, the LEAPS investor's returns would be significantly higher in percentage terms than those of the common stock investor due to the embedded leverage. Furthermore, the capital saved by choosing the LEAPS option can be invested elsewhere (e.g. short-term fixed income securities that currently yields around 4% per year), generating additional returns. This dual-strategy approach allows for a high-conviction sentiment on a potential recovery while also creating a separate, lower-risk income stream, offsetting some of the primary risk of the options trade.

Source: Author's calculation.

Disclaimer: I am not a financial advisor or registered investment advisor. The information contained in this article is for informational purposes only and should not be construed as financial advice. Past performance is not a guarantee of future results. You should always conduct your own research before making any investment decisions.

Disclosure: I/we are long NVO.