(Mark Zuckerberg on Q4-2021 Results Conference Call) In this article about META, I’ll go through different sections in order to gauge if all the fuss (biggest one-day loss of stock market cap in financial history) consequent to the recent Q4-2021 Results Conference Call was justified or not. Just a quick figure: during the last earnings call the term “headwind” was mentioned 34 times (!) and “TikTok” 6 times (!). Brief overview of Company’s business model (ads business + Realty Labs). Quantitative Analysis (on Fundamentals and Graph) Future perspectives DCFs of various outlook scenarios (euphoric, neutral, low, no growth). Conclusion on both qualitative and quantitative basis. A holder, not a buyer. All will be done citing extract from the infamous Q4.2021 Result Conference Call and the Follow Up Call. Long-story short, I sold a substantial part of the stake I owned but did not exit completely. From now on I’m a disenchanted (but hopeful) holder. If you paid even the slightest attention to the recent worldwide news, chances are that you heard about Meta reporting a +37% YoY growth of revenue (totalling more than $117 billion for 2021) with an Operating Profit of $47 billion yet having a couple of problems: Reality Labs, the Company’s AR and VR segment (call it the Metaverse segment if you prefer) is a cash burning machine with high probability of remaining so for the forthcoming future Privacy changes on iOS devices made more difficult the profitable practice of targeted ads Attention competition from other players, particularly from TikTok which short-video format is attracting more and more young people. This showed as the first time ever decline in DAU on the Facebook platform (beware: not the other platforms like IG, WApp..). Starting from Q4-2021, Meta started to report revenue and operating income in two segments: Family of Apps (FoA) and Reality Labs (RL). The Company business model is quite simple, as per the annual report: It means that they generate revenue by “displaying ad products on Facebook, Instagram, Messenger, and third-party affiliated websites or mobile applications”. The buyer pays for ad product based on either the number of impressions or the number of actions taken by users (e.g.: click). The Company generates revenue with two kinds of ads: impression-based ads (they just need to display it) and/or action-based ads. The price per ad is calculated as “total advertising revenue divided by the number of ads delivered” regardless of the type (impression or action-based). In the small “Other revenue” category, they mostly account for fees received by developers using its Payments infrastructure. Reality Labs (RL) generates revenue from hardware products (e.g.: Meta Quest, Facebook Portal, and wearables) and related software and content and it is deemed to be the Metaverse segment. When breaking down for (a) margin (b) growth (c) % of total (see chart attached) we notice a peculiar thing: for every 100 dollars of FoA revenue, 10 dollars are lost for RL. (Author’s work from Meta 10-K) (Source: Meta 10-K) (Source: Meta 10-K) So RL is the growth component of Meta. The fast growth (YoY growth of 100%) can be mostly ascribed to hardware (especially strong Quest 2 sales in the holiday season), while all the cash burning was mainly driven by employee-related costs (payroll, and an increasing R&D headcount). Right now they are employing more than 70k people, quite a lot if you ask me. Important to note that Meta CFO, Dave Wehner said that the 2022 margin outlook will be lower in revenue growth but higher in expenses and so the margins will be lower, without providing a specific target. Of note: FoA (or the advertisement business) makes for the vast majority of revenue. Meta (FB) is the second largest player worldwide for Ad Revenue, with a share of 23.7%, second only to Alphabet (GOOG), as per eMarketer.com. (Source: eMarketer.com) And here it comes AAPL. Back in June 2020 the Company from Cupertino released the IDFA (IDentifier For Advisers) and on 26th April 2021 it uptated it into the new operating system, iOS 14.5, with ATT (or App Tracking Transparency) a big new privacy framework. To make it simple: from that moment on user activity on mobile can be tracked by advertisers and app developers only partially and in an incredibly more difficult way. All users with an iOS 14.5 device will have been asked for permission for tracking and accessing device identifiers, such as the IDFA, but the default mode is IDFA turned off. The user will see this permission for tracking: ( Source: Permission for tracking in iOS 14 or later ) Thrilling to notice that not all users ask not to track, according to Flurry roughly 17% of people worldwide are opting into tracking (in the U.S. this number comes down to only 10%). Still a significant impact. To be honest this little spur did not hit everyone in the same way, indeed, as per PlotProject website: Google Ads can use IDFA on a desktop browser so the user with that IDFA can be targeted when back at home sitting behind the desktop and searching for something completely different. Google Ads will know that the IDFA has been using the Merchant X app and therefore Merchant X can place ads directly targeted at that IDFA. For advertisers there is an alternative if a user doesn’t allow IDFA tracking, Apple suggests its SKAdNetwork feature but the attribution data is not as granular than what IDFA provided so personal ads are not possible. The privacy-focussed feature enables advertisers to still be able to get statistical insights without relying on the IDFA (e.g. to see how many mobile users saw or clicked on an ad and then opened a webpage or installed an app). ( IDFA (Identifier for Advertisers) is a unique, totally random ID number assigned to each and every iOS device by Apple (similar to the cookie in a desktop browser). In addition to browser tracking, IDFA also allows you to track user behavior within applications. IDFA does not collect any personally identifiable information (PII) and can be reset by the user at any time. ) Before moving on, let’s dig a little deeper into a (no more that) cool feature, called the “Facebook Pixel”. The “Facebook Pixel” is a piece of code that you place on your website, allowing you to monitor conversions from Facebook ads, optimize ads, build targeted audiences for future adverts and retarget people who have previously interacted with your website. (from: ). It is completely free to set up and install and you aren't obligated to do any advertising with Facebook. This “Facebook Pixel” is the code responsible for the conversion optimization. For a bit of color, the Pixel allows the buyer to creating a retargeting campaign (to show targeted ads to people who previously visited the website), lookalike audiences (lookalike audiences are created based on shared traits with a specific group of existing prospects) and cross-device conversions (to keep track of audiences when they are using different devices). The Facebook Pixel generates some conversion metrics (ROAS, CPA..) to determine the success of their campaigns. To sum it up: (from insense.pro) , the iOS 14 release negatively impacted ads (especially Facebook’s) in three key areas: Targeting (because of the new privacy framework ATT) Reporting Optimization In particular the reporting problem is quite substantial. The conversion metrics from Facebook Pixel are now inaccurate. One media buyer, Zach Stuck of Homestead Studio, provides some detail on this point in his quote from this Bloomberg piece: “Facebook used to capture around 95% of the sales data from clients. In one case now, there is a 57% gap between sales seen on Shopify and what Facebook is reporting.” During the Q4-2021 Results Conference Call it emerged a less scary number for that gap, 15%, and Susan Li said that they succeed in closing approximately half of ”last quarter gap reassuring that is “a very small slice of the overall”. But she remarked: The management team spent little to no time talking about WhatsApp but when they talked about it, it was great news. The CFO Dave Wehner said that from the messaging platform there is monetization thanks to click-to-messaging ads (a multibillion dollar altready today) that redirects both to Messenger and WhatsApp. Plus he estimates that: “more than 1 billion users are connecting with a a business account every week.” and that they are “partnering with companies like Uber and JioMart to help people book a ride or have their groceries delivered tight from a chat.” Meta is a great solid business, financials-wise. Looking at its balance sheet is almost eye watering: no debt. They also have $16.601 billion in cash & cash equivalents on top of a double amount of current marketable securities ($31.397 billion). So all the liquidity ratios are excellent. Current ratio: (Current assets / Current liabilities) = 3.15 Quick ratio: (Cash & cash equivalents + Marketable Securities + Account receivable / Current liabilities) = 2.94 Cash ratio: (Cash & cash equivalents / Current liabilities) = 0.78 Also the liquidity ratios are great. Debt ratio: (Total debt / Total assets) = no debt Equity ratio: (Shareholders’ Equity / Total assets) = 0.75 Debt to Equity ratio: (Total debt / Shareholders’ equity) = 11.57% Perhaps the only red flag may be the $19.197 billion goodwill, the outcome of recent acquisitions. (Source: Meta 10-K) A quick look at the capital structure. The authorized capital stock is of 9,241,000,000 shares, consisting of: (i) 5,000,000,000 shares of Class A common stock, $0.000006 par value per share (entitled to ten votes per share); (ii) 4,141,000,000 shares of Class B common stock, $0.000006 par value per share (entitled to one vote per share); (iii) 100,000,000 shares of preferred stock, $0.000006 par value per share. Meta reported that Class A common stock will be traded on NASDAQ under the ticker ‘META’ in H1-2022. Regarding the recent deliberate share buyback, as you can see the average price paid by the Company is quite higher than the actual price (around $330 per share for a total amount of $133 billion in Q4-2021 alone), perhaps they will keep on buying more at this lowered price. (Source: Meta 10-K) Of note: the cost of goods sold (COGS) also accounts for the payout of content creators, reflecting the centralization of creators in the project of the Company. But these costs increased 35% YoY to $22.649 billion and management expects this to be higher in the coming year (as cited below). From a technical point of view this situation (-42% from the all-time high) is similar to the -43% decline seen as a consequence of the Cambridge Analytica scandal of 2018 and perhaps the -53% decline right after the IPO in 2012. On these bases we could expect the stock to bounce back, but the probability is not so high. (Source: Tradingview) A quick look back at the recent tech history we can find a similarity also in the AAPL stock fast crash of 2018. Indeed after Apple announced in the Earnings call of November 2018 that they will no longer report numbers of unit sales of iPhones and other devices separately but all together, rumors about the decline of hardware sales started circulating. Looking back, it was a move consistent with the transition to services the Company was doing in order to thrive. The stock market is always a voting machine in the short run, but a weighing machine in the long run, as Benjamin Graham once told. Indeed in the short run the analysts downgraded the stock and the stock plummeted 26% in the span of 60 days (from November to December 2018), the rest is history. (The voting machine acting. AAPL plummeted after “bad” news in the Earnings call of Nov 2018. Source: Tradingview) (The weighing machine acting. AAPL stock market performance up to date. Source: Tradingview) Mr. Zuckerberg set up its seven major investment priorities for 2022 and I’ll just report it here in summary as I think they are quite clear and plain vanilla without sweeping it under the carpet: Reels (effective medium with its short-form video format but needs to get improved on monetization and trying to do it as native as possible. Also increasing competition from Tik Tok that has the best execution so far) Ads (clear trend towards less data available to deliver personalized ads. The estimated impact is $10 billion for FY2022 and it’s mainly due to Apple’s ATT, App Tracking Transparency which limited service Meta was providing to its advertisers and marketers in both performance and metrics. But also new regulation in Europe that can limit the transatlantic migration of data and possibly the move of Meta out of Europe) Privacy (implementing that on the whole Family of Apps) AI (important to maybe overcome the ATT of iOS14.5 and later, but also for the metaverse. They just announced the AI Research SuperCluster which is said to be the world’s fastest supercomputer when completed later this year) Community messaging (moving toward a better group messaging experience as users comments more on private groups than in the public feed) Commerce (striving to collaborate with sellers as Shopify) Metaverse (still a long way to go before profitability but growing at 100% yearly compound thanks to hardware) So the main theme this year is: increasing competition, or more and more headwinds. Competition for attention, the famous eye-ball time. Mark Zuckerberg (CEO) said: I believe this will be the case but I’m not super ready to wager the same amount on the metaverse which may well be the next big thing but for now is mostly about gaming. The Metaverse is indeed mostly about gaming for now. There are good plans and execution also on things like Supernatural (workouts subscription program to do at home) and Horizon Workrooms (the usage of VR to emulate the working space). Progress is also reportedly made in “Project Nazarene”, the first fully-AR glasses from Meta. And last but not least, they are exploring the potential of AR on the mobile, directly from Instagram or Facebook apps to enrich the social experience. I’ll limit to cite the management comment on these estimates because they are already quite eloquent. David Wehner, CFO said: “ We expect first quarter 2022 total revenue to be in the range of $27-29 billion, which represents 3-11% year-over-year growth. We expect our year-over-year growth in the first quarter to be impacted by headwinds to both impression and price growth. On the impressions side, we expect continued headwinds from both increased competition for people’s time and a shift of engagement within our apps towards video surfaces like Reels, which monetize at lower rates than Feed and Stories. On the pricing side, we expect growth to be negatively impacted by a few factors: ▪ First, we will a period in which Apple’s iOS changes were not in effect and we anticipate modestly increasing ad targeting and measurement headwinds from platform and regulatory changes. ▪ Second, we will a period of strong demand in prior year and we're hearing from advertisers that macroeconomic challenges like cost inflation and supply chain disruptions are impacting advertiser budgets. ▪ Finally, based on current exchange rates, we expect foreign currency to be a headwind to year-over-year growth. In addition, as noted on previous calls, we also continue to monitor developments regarding the viability of transatlantic data transfers and their potential impact on our European operations. [...] we believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it's a pretty significant headwind for our business. And we're seeing that impact in a number of verticals. E-commerce was an area where we saw a meaningful slowdown in growth in Q4. And similarly, we've seen other areas like gaming be challenged. And if you look at it, we believe those restrictions from Apple are designed in a way that carves out browsers from the tracking prompts Apple requires for apps. And so what that means is that search ads could have access to far more third-party data for measurement and optimization purposes than app-based ad platforms like ours. [...] And as a result, we believe Google’s search ads business could have benefited relative to services like ours that face a different set of restrictions from Apple. And given that Apple continues to take billions of dollars a year from Google Search ads, the incentive clearly exists for this policy discrepancy to continue. “ (Emphasis added). But on the operating side, Meta is not standing still, indeed Sheryl Sandberg, COO noticed that: And also the Family of Apps is shifting a bit more towards messaging than publicly commenting as reported by Mark Zuckerberg, CEO: He also added that: And again the term “headwind” was used.. Dave Wehner, CFO added: On Reality Labs: And the quarterly results also gave this bad news, feeding the doomsayer. DAUs (Daily Active Users) in one of the FoA segments, Facebook, declined for the first time ever on a quarter-to-quarter basis from 1.930 billion to 1.929 billion. The decline was of 1 million users in US&Canada (out of 196 million, so a -0.5%), 3 million users registered in Rest of the World (out of 622 million, so a -0.5%); whilst in Europe the number was up 0.3% and 0.1% in Asia-Pacific. I’ll let you judge for yourself if these figures are bad or not, but it certainly is something worth noting and putting into the context that the whole “Family of Apps” actually gained 10 million DAP (Daily Active People) for a new total of 2.820 billion, meaning a +0.3%. (Source: Meta Earnings Presentation Q4-21) So is it just the “old” Facebook losing appeal perhaps in favor of Instagram? We can’t say that with any certainty but what is clear is that TikTok is the real problem here, as recognized by the President, CEO and co-Founder of Meta: Mark Zuckerberg himself: (Source: Statista) To add some context, let’s look at the competitors: Telegram reported 55 million DAU in Q4 (3% of Facebook’s). SNAP reported 319 million DAU in Q4 (16% of Facebook’s); Pinterest 432 million DAU (22% of Facebook’s); TikTok 1000 million MAU (remember that this data includes China and only 100 million MAU are from the US) (50% of Facebook’s). We appreciated the honesty and candor of the management team when talking about the real competitor for Meta’s future growth: TikTok. Indeed it competes directly with Reels that is deemed to be the main growth driver for the company in short-term future. David Wehner, CFO, in answering a question during the Conference call about TikTok: I calculated FB fair value with a discounted cash flow method (DCF) resulting in a number for Enterprise Value (EV). EV gives the aggregate value of a firm as an enterprise. It is calculated as follows: I find it very useful as it accounts also for Debt and additional info otherwise neglected. All data used are publicly available. In order to weight for different growth prospectus, I used four different scenarios: bullish (18.7% growth in the next 5 years) neutral (10% growth in the next 5 years) bearish (5% growth in the next 5 years) no growth (0% growth in the next 5 years) Looking at the FCF Meta provided and yearly data (see below), I chose to be conservative and use a quarterly $7.5 billion figure, so $30 billion yearly, as the starting value for all the DCFs. Past yearly data were as follows, $ billion: 17.5 (y2017); 15.4 (y2018); 21.2 (y2019); 23.6 (y2020); 39.1 (y2021). (Source: Macrotrends) (Source: Meta Earnings Presentation Q4-21) Here are the resulting EV and the delta from current EV (of $596 billion): bullish (18.7% growth for next 5y) → undervalued by almost 50% neutral (10% growth for next 5y) → undervalued by almost 20% low (5% growth for next 5y) → OVERvalued by almost 20% no growth (0% growth for next 5y) → OVERvalued by 28% As you can see the downside risk is quite limited to the same amount of upside potential, that’s to say that we have an almost balanced risk-return investment curve, slightly tilted toward the reward. Attached the results of the four scenarios. (Source: Author’s work from). Just for exercise I also posted the results with a starting yearly FCF of $39 billion, that is the one reported by Meta Platforms, Inc. . It yields higher results but I recommend against using it. (Source: Author’s work from). Looking at its P/E ratio of 16 and Rev growth of 13%, Meta is cheaper than its peers: MSFT (P/E 27, Rev growth 11.2%) AAPL (P/E 25, Rev growth 2.8%) but not relative to GOOG - GOOGL (P/E 22, Rev growth 17.5%) which is quite attractive indeed. The situation appears clear but far from easy to navigate. There are headwinds. I think the management team has done an excellent job in the past and are honest in their declarations. They seemed very focused on solving the TikTok competition problem by keeping on the commitment with Reels (its own short form video format). This is something I think they will overcome. I’m a bit more scared about the regulatory problem (not just the UE and the transatlantic migration data) especially in the face of foreign players which may be less regulated, creating a de facto uneven playfield. The growth surprise may come from the metaverse, this not-well-defined-yet field in which they are almost all in. On the qualitative side I’m pretty confident Meta Platform, Inc. will thrive in the next 5 years. On the quantitative side, regarding valuation, I think the company is a hold, not a buy. I personally reduced my exposure to a little percentage of the overall portfolio and intend to keep on holding but not buying anymore. Regarding the revenue growth, for the next couple of years ads will still be the major driver and since revenue form that is a linear function of number of active users, the expenses will be the limiting factor here. They clearly stated that they intend (and need) to add on the number of employees (especially to comply with heavy and increasing regulation), for keeping this operating margin, revenue must increase 17% in 2022 (with total expenses in 2022 in the range of $90 billion) which is what most analysts are expecting. I am not. Sources used more than once: link to Earnings Presentation Q4-2; link to Fourth Quarter 2021 Results Conference Call; link to Follow Up Call. : I am/we are long FB, AAPL, GOOG, GOOGL, MSFT. Overview

Intro

Business model

The ATT-IDFA controversy

Facebook PixelWhatsApp anyone?

Quantitative Analysis

Fundamental Analysis

Technical Analysis

Future

on Reels

on Metaverse

(Source: Google)Future estimates

(Source: Meta Earnings Presentation Q4-21)TikTok, a tough competitor

DCF

Conclusion

Disclosure

info@peterlavi.com

About

Physician (MD) ・Stocks and ETFs investor ・10+ years of investing

・Keen on reading, reading and reading ・Writing on Forbes, SeekingAlpha, GuruFocus, and Yahoo Finance

Meta, Password: “Headwinds”

Meta, Password: “Headwinds”

2022-02-13 19:42

2022-02-13 19:42

Pietro Lavisci, MD

Pietro Lavisci, MD //peterlavi.com/favicon.png

Breaking down the reasons behind the recent plunge and why I'm a holder but not a buyer...

Volatilità in Saldo: Leva Asimmetrica e Copertura del Rischio di Coda

Pietro Lavisci, MD //peterlavi.com/favicon.png

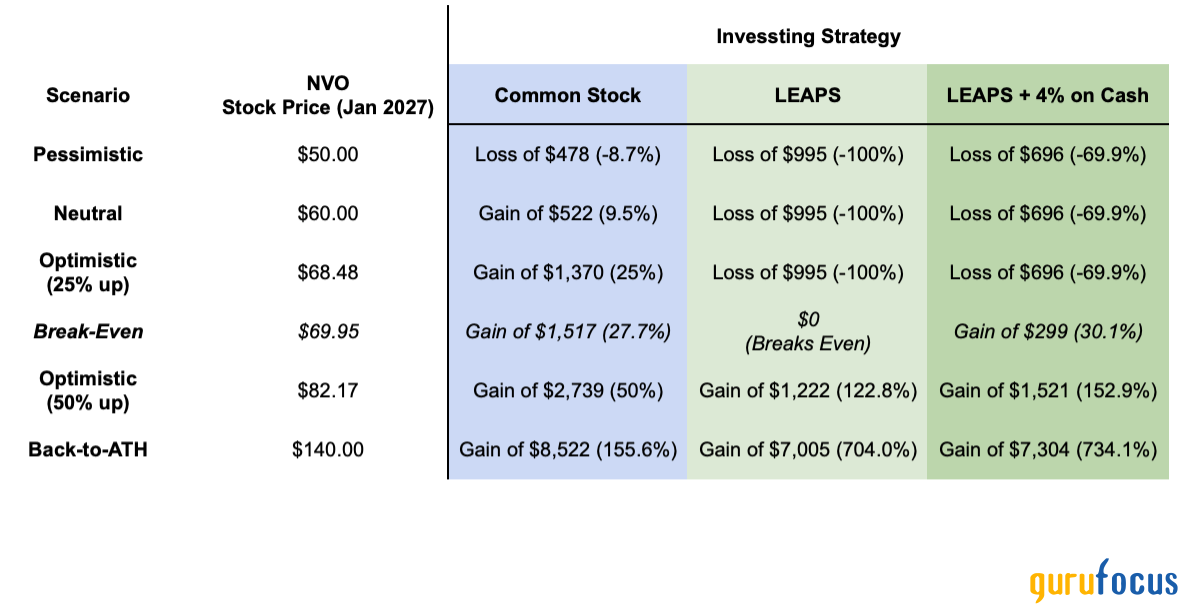

Novo Nordisk: Do LEAPS Make Sense Amid Selloff?

Pietro Lavisci, MD //peterlavi.com/favicon.png

Forbes Published Our Analysis

Pietro Lavisci, MD //peterlavi.com/favicon.png

This material is provided for informational purposes only and does not constitute investment advice. Trading financial instruments involves significant risks, including potential loss of capital.

Past performance is not a reliable indicator of future results.

Market prices fluctuate, dividends and returns are uncertain, and exchange rate movements may affect investments denominated in foreign currencies. Each individual must assess their risk tolerance accordingly. No universal investment formula exists, and no financial instrument is risk-free. The data used in this material is obtained from sources believed reliable, though accuracy cannot be guaranteed. Being an investor means assuming risk with the aim of achieving returns.

Your capital is at risk | Copy Trading does not amount to investment advice | Your investments value may go up or down

www.peterlavi.com ©